Table Of Content

While the home closing process usually takes 30 – 45 days, you should be prepared to close as quickly as possible. Closing in 30 days is ideal, but it’s usually only possible if the buyer’s financial readiness isn’t a barrier and no issues are discovered during the appraisal and inspection of the seller’s home. Standard mortgage loans took an average of 49 days to close in September 2021.

What to Expect When Closing on a House

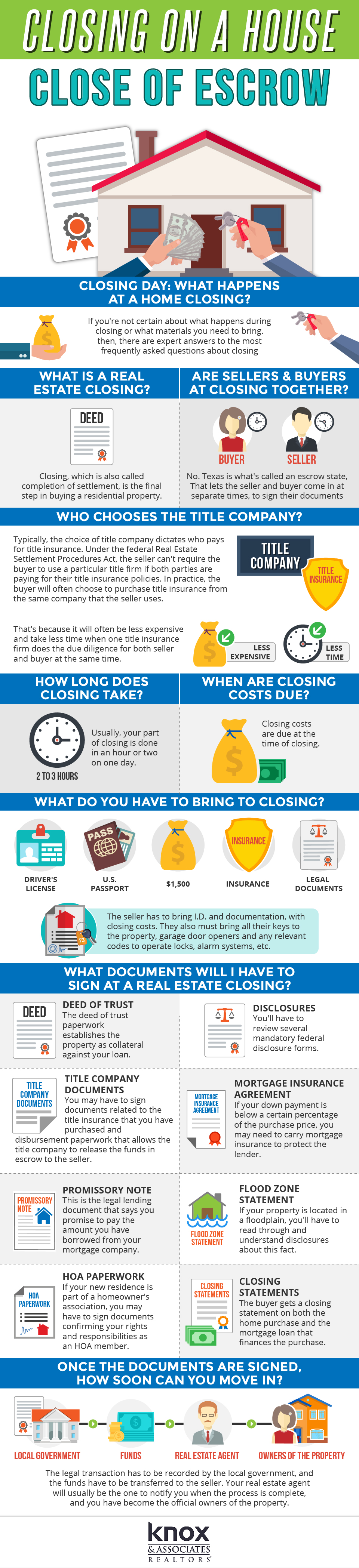

On closing day itself, the homebuyer must sign lots of paperwork that finalizes the deal. Often there are many other parties present for closing day, including the seller, the lender, real estate agents, the closing agent and often an attorney who will also review the paperwork being signed. An appraisal is a professional assessment of the worth of the home you’re interested in buying, ordered by the mortgage lender.

With the right agent, taking on the housing market can be easy.

And if you’re getting a 15-year fixed-rate mortgage then you’re in even better shape. You’ll be able to pay off your mortgage in a reasonable amount of time. It’s time to prepare yourself for other potential delays that could hang up your ability to close on a house. These problems could happen any time after your offer—even up to and including the day of your closing. When you’re this close to owning a home, you don’t want to do something dumb to mess it all up. So make sure you have a solid team on your side, starting with an experienced real estate agent if you don’t already have one.

How Much Money Do You Need To Buy A House? A Cost Breakdown

From opening an escrow account to hiring a real estate attorney, all involved services and entities cost money. These costs can snowball into a lot of cash if you aren't careful. For instance, home and pest inspections are crucial to prevent you from buying a property with hidden—and costly—problems. But many such services take advantage of consumers' ignorance by charging high fees. Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome. You can expect to pay 2 to 5 percent of the mortgage loan in closing costs.

Submit earnest money: 1 day

Use this calculator to estimate closing costs based on your home’s sale price and other purchase details. Homeowners insurance provides financial protection if the home is damaged by fire, severe weather, vandalism, or other incidents. Your lender will require you to have a policy, as it has a significant financial stake in the property. You walked through countless houses before finally finding the one you wanted. You stressed over how much to offer, then sweated while waiting for the seller to accept.

The Process for Buying Land with Cash in 11 Simple Steps

Plus, it saves a lot of valuable time, and you can avoid some frustrating back-and-forth with your lender. Sanchez says buyers who come into the application process prepared tend to hear back from their lender quicker. Ideally, before you reached this step you obtained preapproval for a mortgage and crunched the numbers to make sure the home is within your approved budget.

How long each closing step takes

Delays are more likely when mortgage application volume is high, because anyone working on your closing can get backed up with too much work. It can be hard to schedule an appraisal or a home inspection if those professionals are booked solid. Many people trying to buy a home or refinance during the pandemic had this experience.

A cash offer can also work in your favor if the owner has put in an offer on another home, and they need a solid offer on their home to move forward. Underwriting is the process of evaluating your file and making the final decision on your loan. In the worst-case scenario, the underwriter could find an error or discrepancy on your application the loan officer didn’t see, and you won’t qualify for the loan. At the very least, you’ll likely be hit with a ton of document requests once you’re under contract. After you’ve submitted your application with all its documentation, the ball is in the lender’s court. They’ll need to go over your documentation with a fine-toothed comb and make sure everything is complete, legible, and correct.

You should also bring a list of important contacts in case any issues come up. This may include your real estate agent or attorney, if they’re not present at closing. Earnest money is the money you put down to show the seller you’re serious about buying their home and protects the seller if you were to back out of the deal. The money is held in an escrow account until the deal is completed, then applied to your down payment or closing costs. Thoroughly reviewing this document is one of the most important steps you’ll take when closing on a house. You’ll want to compare the Closing Disclosure to the loan estimate to make sure there aren’t any discrepancies.

How soon after a mortgage closing can you apply for a new credit card? - The Points Guy

How soon after a mortgage closing can you apply for a new credit card?.

Posted: Wed, 09 Sep 2020 07:00:00 GMT [source]

Here’s a list of 15 questions you should ask before buying a house to make sure you wind up with a good deal. After sifting through home listings, ensuring your offer was competitive, and jumping through financing hoops, your offer was finally accepted on a house that’s just right for your family. In addition, ask the seller what homeowners insurance they have since you may be able to get a policy through their insurer more easily. That’s a non-arm’s length transaction that can have tax and legal implications. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If you're willing to speak up and stand your ground, you can usually get junk fees and other charges reduced or eliminated before you go to closing.

Finally, check to see that nothing included in the purchase agreement was removed. If possible, it is advisable to lock in the interest rate for the loan in advance. That prevents you from being at the mercy of market fluctuations, which could cause rates to rise before you finalize your property purchase. Even a 0.25% rate hike can significantly increase your monthly payments and the amount of time it takes to repay the mortgage. If you’re getting a mortgage, whether you’re buying or refinancing, your lender will order a title search and you’ll have to purchase a lender’s title insurance policy. You’ll have the option to purchase an owner’s title insurance policy, too, which experts recommend doing to protect yourself.

How long does it take to sell an apartment in NYC? - Brick Underground

How long does it take to sell an apartment in NYC?.

Posted: Thu, 24 Feb 2022 08:00:00 GMT [source]

The escrow disclosure, detailing the charges that will be incorporated into your monthly payment for taxes and insurance. For sellers, the faster they sell their property, the sooner they can stop paying the mortgage and upkeep. This can be especially important if they have already purchased a new home and are carrying both mortgages for the time being. If a major problem is found, the buyer might ask the seller to make repairs before closing — or might even want to back out of the purchase altogether. Loan approval can take a month or longer when closing on a house, so it typically comes through toward the end of the closing process. This is the last major piece that needs to fall into place for your closing to wrap up as scheduled.

Without the mortgage paperwork to sign, this should be pretty simple — less than an hour, and you’re finished. But Pohl has seen some closings where the buyer was paying cash drag on for more than three hours because of improper purchase agreements. As a buyer, you have several responsibilities during the closing, including getting approved for your mortgage, acquiring title insurance, and readying your finances for the final sale. You should also avoid doing anything that could negatively affect your cash flow and credit score. The amount of time a home spends on the market before selling varies widely depending on your local market.

The goal of this step is to let the buyer inspect the property at their leisure, without feeling pressure from the seller. “Counter-offers can go back and forth between the buyer and seller until they settle on agreed upon terms,” says Horner. “This back-and-forth might be succinct and tied up in a day or two. Closing costs vary and are often estimated at 2% to 5% of the home's sale price.

No comments:

Post a Comment